Kids and Family Gift Ideas

This means that if you want to give these 2,000 shares away for free, you could be liable for Capital Gains Tax calculated on the difference between the current market value of the shares (£10 x 2,000 = £20,000) and the acquisition value of the shares (£0.001 x 2,000 = £2) - so the taxable 'gain' is £19,998.

gifting shares to family members UK FPM

To gift shares to a member of your family (for instance, transfer an investment to your spouse, civil partner or children), you'll need to log in to your account and send us a secure message. The message should detail the investment (s) you want transferred, and confirm the transfer is a gift. For investments transferred as a gift, stamp duty.

What You Need to Know Before Gifting Money to Family Savant Wealth Management

Transfer shares as a gift: You'll need to complete and sign a stock or share transfer form (Form J30), which includes the details of the person to whom you're gifting shares. Then submit completed forms with any attached shares for gifting. Your share dealing platform should be able to walk you through this.

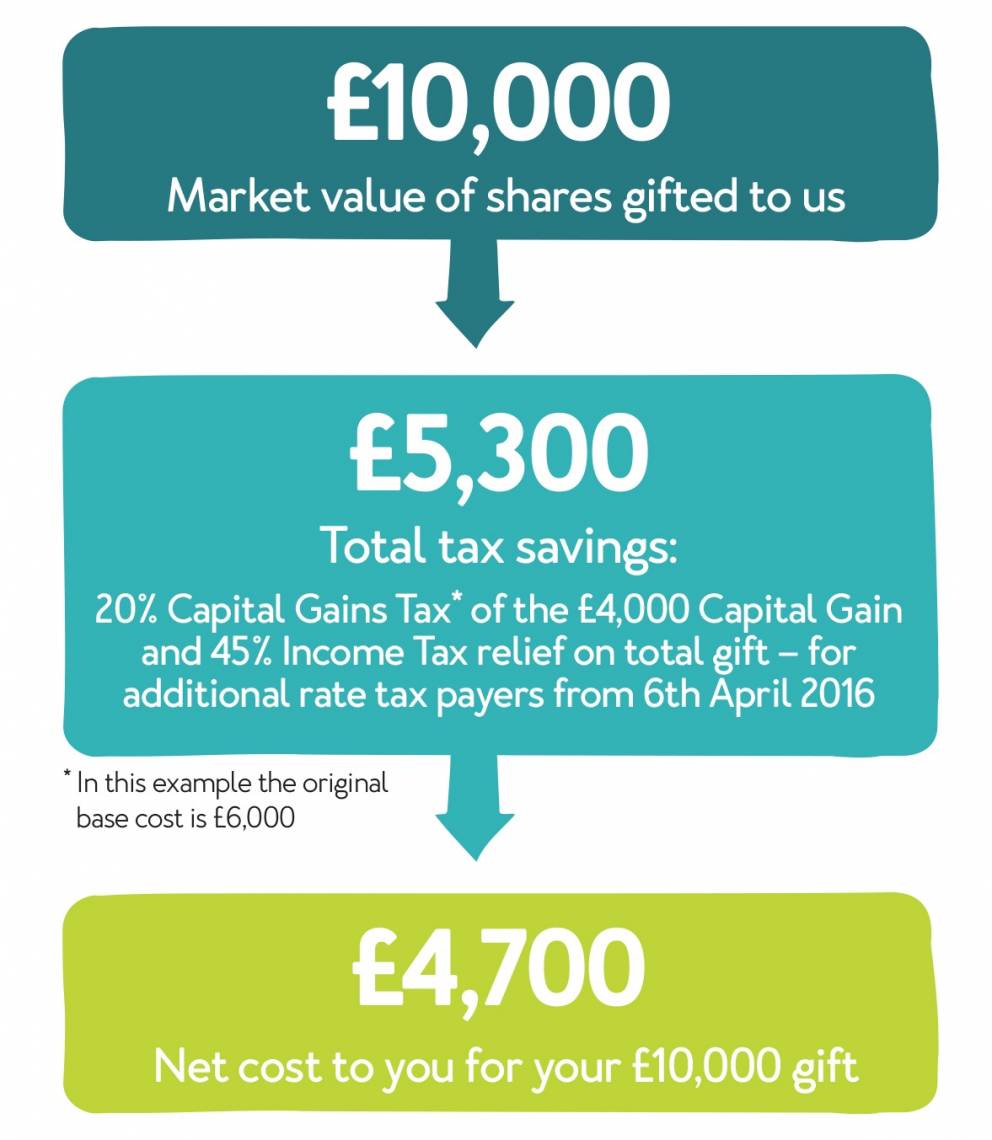

Donate Shares to Charity Make a Charitable Gift of Shares

At the date of the gift the shares are worth £40,000. Dad's capital gains tax liability is 18% of £30,000 (ignoring the annual exemption). Dad and son agree to claim (see below) gift relief. As a consequence, son is treated as now owning shares with a base cost to him of £10,000 (i.e. £40,000 - £30,000) and effectively Dad is treated as.

GIFT CERTIFICATE for Custom Family Portrait up to 6 members Etsy

Gifting shares to family members uk is also a deemed disposal of shares for capital gains tax purposes. As the gift is being made to a connected party, it is a deemed disposal at market value. The problem in the case of a gift is that the person making the disposal receives no monies out of which to pay any capital gains tax which may arise.

Gifting to Family Members Pitfalls and Benefits Family members, Family, Members

Gifting shares in the family business has a CGT consequence as the gift is deemed to take place at 'open market value' and in most cases, the market value will not be known. The open market value is the estimated value of the shares if the transaction took place between a willing buyer and willing seller. Tax would then be payable on the gain.

Gifting Shares Guide for UK Startups and Companies

Transfer Shares to Family Member: Tax Implications UK. Posted 9th December 2021 by by ilyas Patel. Whether gifting shares for your child's further education or surprising your spouse with an unconventional Christmas present: shares are the gift that keeps on giving!

Printable Family Member Gift Letter Template Printable Templates

Generally, in the UK, one is allowed to give a tax-free gift of a cash value of up to £3,000. This annual exemption if not used in one year can be rolled over to the following year, but you are only allowed to take advantage of the rollover one time. For example, imagine in 2020, your father gave you a gift worth £2,000.

Printable Family Member Gift Letter Template

There may be a variety of reasons for shareholders who gift shares to their family members. The most common reasons are as follows -. To provide financial support to your spouse. The necessity of lowering your households tax burden (tax efficiency). To teach your child how to accumulate wealth and how to manage family finances more effectively.

Are gifts given to family members taxable to them? Tax Tip Weekly YouTube

But her friend must pay Inheritance Tax on her £100,000 gift at a rate of 32%, as it's above the tax-free threshold and was given 3 years before Sally died. The Inheritance Tax due is £32,000.

Family Presents 10 Unique Gifts for Everyone to Share Imperfect Homemaker Unique family

There are some additional exemptions for gifting money to relatives. Wedding and civil ceremony gifts: You may give anyone, regardless of their relationship to you, £1,000 per person as a wedding or civil ceremony gift. For a grandchild you may give them £2,500 and for a child you may give them £5,000.

New penalty 2022 Header

These instructions tell you about the basic Capital Gains Tax treatment of gifts. You will find more information on the various reliefs for gifts at CG66450+.. In this section of the instructions.

Personalized Gift Ideas For Every Member of Your Family News Anyway

There is no requirement to inform Companies House of share transfers and new shareholders until the next confirmation statement is submitted. 1st Formations offers a Transfer of Shares Service for just £69.99 + VAT. This includes the Stock Transfer Form, Meeting Minutes and Share Certificates.

10 Unique Gifts for the Whole Family Sparkling Minds

You may be able to claim Gift Hold-Over Relief if you give away business assets (including certain shares) or sell them for less than they're worth to help the buyer. Gift Hold-Over Relief means.

Plan to Gift shares to family members

Note: From 6 January 2024, the main rate of class 1 National Insurance contributions (NIC) deducted from employees' wages reduced from 12% to 10%. From 6 April 2024, that rate is reduced further to 8%, the main rate of self-employed class 4 NIC is reduced from 9% to 6% and class 2 NIC is no longer due. Those with profits below £6,725 a year.

Gifting Shares Guide for UK Startups and Companies

Your spouse or civil partner. You do not pay Capital Gains Tax on assets you give or sell to your husband, wife or civil partner, unless: you separated and did not live together at all in that tax.

.